Home

-

Tips to Make Your Legal Writing More Effective and Powerful

As a lawyer, having the right legal writing abilities is of utmost importance – regardless of how confident you are as a writer. It’s essential for crafting court documents, including motions, discovery papers, briefs, and memorandums, in addition to composing client emails, letters, and internal memos within an office setting. Legal writing encompasses so much

Continue Reading “Tips to Make Your Legal Writing More Effective and Powerful”

-

The Top Reasons to Pursue a Law Degree

With job security, competitive salaries, and esteemed prestige associated with law jobs, it’s no wonder why studying Law is one of the most sought-after academic paths worldwide. So what are some of the best reasons for pursuing a career in this domain? Does investing time and energy into such studies still pay off today? Law

-

History of the Roman Law

Romans have always been following the laws and regulations of the empire, starting from its foundation in 753 BC up to this day. The very first legal process that was integrated by Justinian Emperor was the historical Corpus Juris Civilis. Of course, there have been changes in the laws throughout the entire period of the

Recognized and trusted by the best

Need original and quality research papers on legal systems? Order from writemyessayforme.cheap and achieve incredible results!

The best family lawyer in Vancouver combines extensive legal knowledge with a compassionate approach, expertly navigating the complexities of family law issues like divorce, custody, and property division. With a commitment to achieving fair outcomes, they provide personalized guidance, ensuring clients’ rights and interests are well-represented.

Whether you are struggling with your studies or you are an ESL student who needs a helping hand, BestCustomWriting can help you out.

Laanius.dk is an analytical portal that studies and compares financial products from Denmark

Choose any of Essayshark essay writers to help you with writing academic papers of any academic level.

About

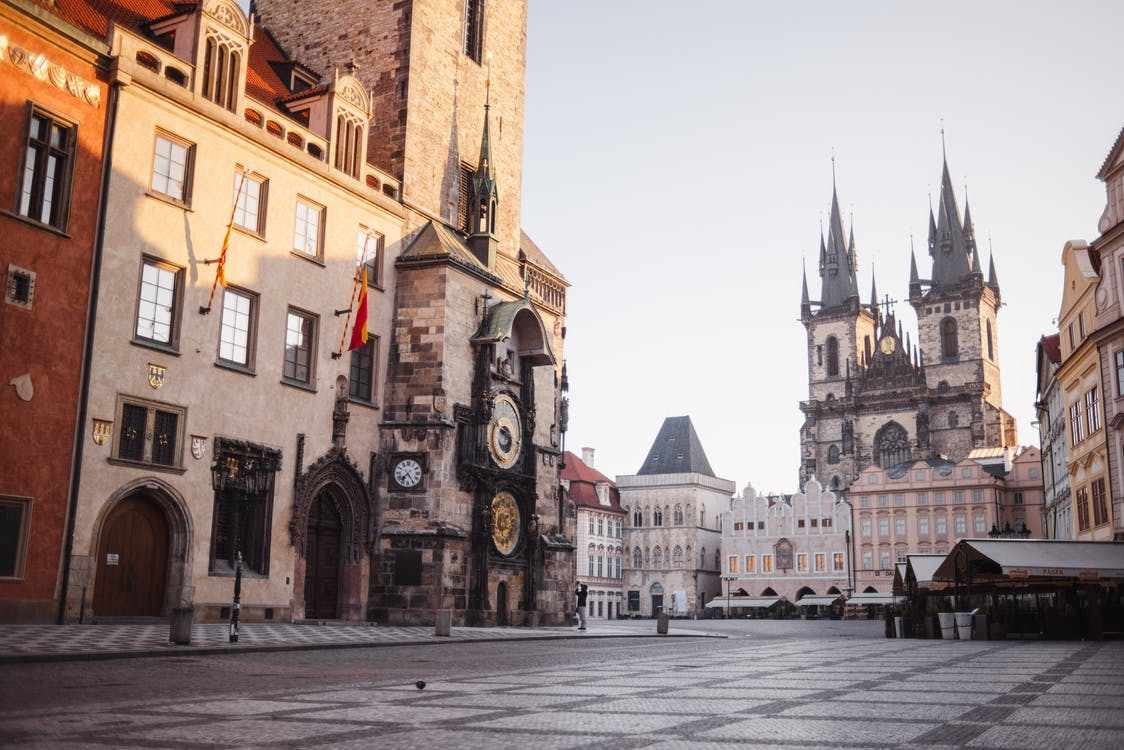

This blog is about legislative law, the history of law making. Details the historical development of law in Europe. During the Middle Ages and Modern times in Europe national states and national legal systems were formed. Between them quite a lot of differences, but also a lot in common. And this is not surprising, because they developed under similar conditions.

European law is the totality of legal norms, which includes European integration law, legal norms that ensure the functioning of the European system of human rights protection, as well as other legal norms of European international treaties.